Radically destroying debt, re-establishing social contracts, and placing value in the hands of communities: Gavin Turk talks to filmmaker Dan Edelstyn, artist Hilary Powell, and political economist Ann Pettifor about building a new economy based on promises and trust

Gavin Turk: Dan and Hilary, as we’re talking about the future I want to know about your new project. Before that though, let’s go back a little bit and talk about Bank Job, your recently completed project. Can you remember and share the time when you thought ‘We need to do this; we really need to make some work around the issue of debt?’

Dan Edelstyn: Bank Job came along after our first film that we made together, which was called Vodka Empire, where we tried to resurrect my great-grandfather’s vodka distillery in Ukraine – it all went terribly wrong on many levels, as it was probably destined to. We were left with the question, what do we want to do next? I furiously started reading books – George Orwell, Leo Tolstoy, John Berger, all sorts. It helped me to get an orientation on why I might write, make films, or do anything at all. Around that same period, a neighbour from across the street asked whether I’d heard about this group called Strike Debt (now Debt Collective) in America who have been buying up and abolishing student and medical debt. There was something about the coincidence between that moment and the kind of soul searching I’d been up to; the two things came together. So I started researching the group in New York, and I read the books that they were publishing. I began to have an eerie feeling of seeing through the illusion of money. I studied history at university, but this gave me a totally different perspective on contemporary history; I could see forces at play through the analysis that this group had put together which I was never previously aware of. It was like scales falling from my eyes around the morality of money and debt. I started to think as a filmmaker again: How could we use film to make this visible? I wanted to turn this abstract stuff into something with a concrete and compelling storyline. So we went to New York and met up with them. We still didn’t have anything like a film, but we knew we wanted to try and do the same in Britain – buy debt and destroy it. We needed to start in our home, and Creditocracy: And the Case for Debt Refusal by Andrew Ross was an inspiration in prompting us to ask the question, was Walthamstow – where we live – a creditocracy? We started to talk to people about debt, the dark twin of money. What really started to capture people’s imaginations was the idea of printing the money; it was a way of enabling us to raise the kind of sterling needed to buy the debt.

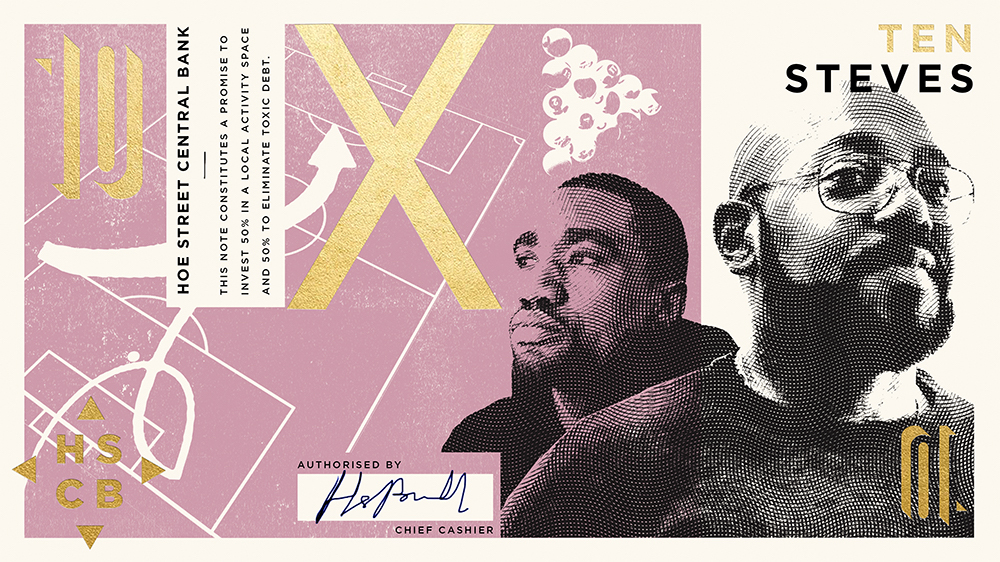

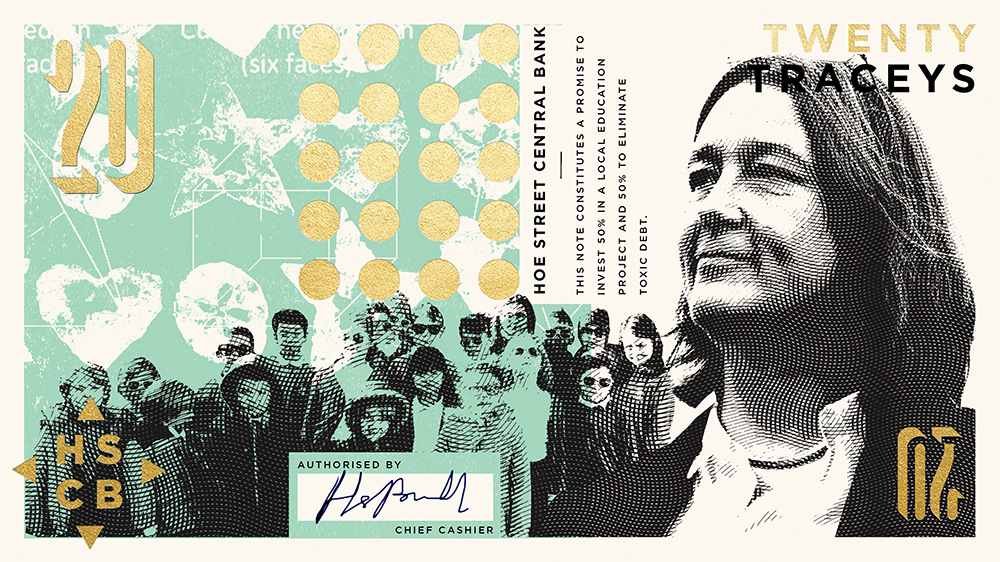

Hilary Powell: What had been a lone endeavour of Dan as ‘The Debtonator’, in a kind of superhero genre, gradually took on more of the characteristics of a classic heist. On a family road trip, talking through the project it became the Bank Job, and from there things took off. Deciding that we’d buy up the debt by giving ourselves the power of a central bank to literally make money and print our own banknotes became a way of engaging people in this whole process. We were told we should get permission and that we could be shut down – but we figured that we were a rebel bank, and we weren’t printing out sterling, so we decided to proceed with our printing and not worry too much about legality. Once we got a physical space for this it all started to happen quickly. We occupied – via a Welsh coworking cooperative, strangely – a former bank on Walthamstow High Street, and it became a community endeavour, employing and training local people, on the London living wage, to learn and share the traditional print techniques we were using to make our cash. It snowballed as more and more people got involved, and the idea of a community heist taking on the power of finance became contagious. The aim was to print and exchange or sell enough of our Hoe Street Central Bank (HSCB) money to be able to: a) buy up £1.2m of local debt (with £20,000), and b) to share the rest (£20,000) between the local organisations who featured on the notes – a primary school, youth project, foodbank, and homeless kitchen. We wanted it to be both direct mutual aid and something that contributed to actually beginning to change the system through education and exposure, and play around with ideas of value: the value of art, of how we value each other, money, our communities…

Gavin Turk: Creating a currency creates a community. If I look at the system of the Brixton pound, a community got created through this. When we look at a community that gets built on the absence of money, on debt, that debt becomes almost a prison in a way. Debt puts people in that system into a place where they have to behave in a certain way; they’re enslaved by it. It also does make a few people rich. What really is debt?

Ann Pettifor: My work started from the point of view of sovereign debt. I was working on the debt of the poorest countries and a global campaign – Jubilee 2000 – aimed at cancelling the debts of the poorest countries. At the end of the campaign I wanted to understand why low-income countries had built up debt. Everybody said it was because of the oil price rise in 1973. I didn’t believe the story I was hearing, so I moved to the New Economics Foundation and started to research the origins of the debt crisis. I realised that central to understanding it all is to understand the nature of money.

Money is basically a social technology. Printed money is the tangible technology of our social arrangement to fulfil obligations. Credit is based on the Latin for ‘I believe’… ‘I believe you will fulfil your obligation to repay.’ Our social arrangement, the thing that we call money, is based on an obligation that if not met, ultimately becomes a debt. David Graeber, in his wonderful book Debt: The First 5,000 Years, argues that societies had credit systems way back then. To simplify: the credit system involves, for example, a village with a hairdresser on the one hand, able to cut hair, and a thatcher on the other. They need each other’s services. If one provides a service to the other, there is an obligation to repay or reciprocate. In the village, a chief or high priest or whoever’s the boss, oversees obligations and upholds standards of measurement (for example the standard length of a cloth or size of a beer) and resolves conflicts between those exchanging (transacting) services. The hairdresser says to the thatcher, I’ll cut your hair, but afterwards, please thatch my roof in exchange. The chief oversees this and says to the thatcher, “Okay, she’s cut your hair. Here’s the promise that you’ve made – and I’m here to uphold that promise.” In the meantime, the hairdresser cuts the butcher’s, the carpenter’s hair, and so on. The role of the chief is to say, these promises were made, please fulfil them. And that’s how the credit-based monetary system originates – with the head of the village acting as the ‘central banker’.

What happens when a new tribe turns up at the village and seeks to undertake transactions? They might say, “Look, we’ve got animal skins, and we’d like to exchange these for your corn.” Because they are strangers and not answerable to the village’s ‘governance’ system, villagers are unsure how to trust them as there’s no chief to oversee and negotiate this exchange. So they revert to barter – the exchange of one commodity for another. David Graeber argues our credit-based monetary system is not barter. Barter was a system that operated in places where there was no trust and no management of trust.

Neo-liberals, conservatives, and classical economists call money, barter, based on a commodity like gold. But for 5,000 years money has been based on promises: ‘the promise to pay’ and the enforcement of that promise, trust. So that’s why all money is debt, because the use of the credit money system assumes the making of an obligation which has to be upheld. Five thousand years ago people were doing this, and the chief had the role of standardising – putting a measurement system in place for balancing exchanges or transactions. That setting of a standard for exchanges became the currency.

Today in Britain we all share a currency, pounds sterling; but when we cross the border to a foreign country, we have to use an alternative currency. The power of the chief has been usurped, and power over our monetary system now rests in financial markets based in places such as Wall Street. To oversimplify, our monetary system reliant on promises to pay and millions of daily transactions are no longer managed by our local ‘chief’, but have been captured. Today the system is effectively managed by the one per cent. Our obligations are captured in the form of bonds, which themselves are bought and sold so that these social obligations are now commodified and transformed into an asset. Our social relationships have been commodified, and a few have become rich on it…

Gavin Turk: I’ve got this nagging thought in my head: I took £200 out of the hole-in-the-wall around the corner from my house at the beginning of the year and only yesterday spent the last pound – the only actual physical money I’ve had this year. I’m doing all my transactions down a wire, which is also charging me a little every time I spend any money…

Ann Pettifor: Cash is so subversive to today’s monetary system because it can’t be traced. If, in a coffee shop, you wave a card over a machine, this is a promise to pay the coffee shop, but it also becomes a bit of data that can be sold on. It’s extraordinary the degree of control, and the rates of return, that the one per cent demand.

I’m passionate about the question of what rates of interest are charged on these intangible, social obligations – a promise to pay. For example, imagine a young person living in council accommodation somewhere in the east end of London, who works, precariously, for Deliveroo. If that person applies for a loan, the bank might be happy with her application and promises to pay, but because her loan is risky, offers her a mortgage with an interest rate of eight per cent. Her income doesn’t rise by eight per cent every year, but the interest on her mortgage does. So she uses the loan to buy a tiny flat in east London and then obviously ends up defaulting on it. High rates are a major cause of financial or economic failure, which is why they should be regulated. Under the ‘free market’ monetary system, they are not regulated. Hence the inevitability of financial crises.

Let’s say we have a complete collapse of the whole thing, because of a climate breakdown. The whole system blows up and everything is destroyed. There are only a few people left. What could we do? We could, say, begin again. We will have lost the system governed by the invisible hand of ‘markets’ – the one per cent – and will be free of all of that. We could begin to build a new world and a new community, based on promises and trust. We could begin to transact our services, “I’ll care for you or I’ll sing for you, or I’ll paint for you.” And we could then begin to build up a system of trust once more. The question would then become, whom do we want to be in charge of all this? How do we want to manage this?

Gavin Turk: The relationship between art and money is mysterious. How do we put a price on a painting? How do we put a price on creativity, whatever that is? Not that I don’t know what creativity is, but the moment I try to commodify it, it goes weird. Dan and Hilary, I know when the Bank Job project got to the point where you actually had to do the deal and buy the debt, it became a little problematic. Can you expand on that?

Dan Edelstyn: In America, they had a couple of debt buyers who went into Occupy and collaborated with the Strike Debt (now the Debt Collective); whereas in Britain, there were no debt buyers who were on the same page in the beginning. We were going into a world where we had no contacts and were trying to persuade people to help us. We did eventually find a good guy in the Midlands, called Roland, who had been buying debt for 20 years and wanted to make amends in some way. The reason we could buy £1.2m of predatory catalogue and credit card debt was because of the way the secondary debt markets work. Debt is bought and sold as a commodity. The older it gets, the lower its grade. As a form of local ‘bailout of the people by the people’ we wanted to focus on local debt; in what was essentially a matter of interrogating spreadsheets we honed in on this high-interest debt from the surrounding postcodes of E17, Walthamstow, London. This process was fraught with difficulties, and it was never intended as a scalable solution to the debt crisis, but a way of exposing in a dramatic way the injustices of the secondary debt markets, and in turn, the wider financial system that forces people into debt. Our act of debt cancellation was one spark in a movement to both illuminate and counter these unjust systems. This was done through collective action and in this case art – not just in bringing a community together in the printing of the banknotes but the staging of an explosion of this debt in a transit van in front of the towers of finance of Canary Wharf. This action was called Big Bang 2.

Ann Pettifor: Can I illustrate that with the work I was doing on an international level? Like many other low-income countries, Peru had outstanding debts – for example, foreign obligations. A New York company called Elliott Management started what’s often called a ‘vulture fund’. That fund deliberately sets out to buy the ‘distressed’ debt of poor countries when the value of that debt has fallen, because non-payment is expected.

The poor country is indebted because of economic needs, such as buying computers, so has to borrow hard (foreign) currency in order to pay for imports. They sell their copper, or whatever they can, to obtain dollar bills, and use their commodities (assets) as collateral to borrow foreign currency. And then suddenly the price of the asset against which they have borrowed, such as copper, collapses. They earn less foreign income and can’t repay the borrowing. It is at this point that Elliott Management steps in and buys the debt Peru owes, and waits. In the meantime pressure groups lobby for unjust and immoral world debt to be cancelled, and call on the official creditors, the IMF, the world bank, and Britain and Germany, and the United States and Japan – to cancel the poor country’s debt. It works and some debt gets cancelled. Once more the country’s ‘books’ are restored to balance, and they raise more hard currency. It is at that point that Elliott Management demands repayment in full of the old debts. Having originally paid, for example, 10 cents in the dollar for the debt, the company demands repayment of 100 cents in the dollar. If Peru (or Argentina or Haiti) refuses, the American company can take the sovereign debtor to an American court. Judges in New York bow to the interests of a Wall Street corporate and argue that Elliott’s repayment must take precedence over other repayments. If the sovereign offers only 10 cents in the dollar as repayment, US courts have the power to penalise that sovereign debtor. This is achieved by using the IMF to block the sovereign’s access to foreign currency. That is the fate of many poor, sovereign debtor countries. It’s an issue that is difficult to explain because it’s hard to understand and talk about the international financial system.

Gavin Turk: Dan and Hilary, weren’t you trying to get a licence for buying debt?

Dan Edelstyn: So many communities all around the country got in touch and wanted to do the same thing – branches of HSCB popped up all over the country. The barrier was the fact that we didn’t have financial conduct authority regulation, but also the feeling that possibly we don’t need to replicate it in the same way – maybe it’s done its job, and it’s travelling out into the world in a film and book and sparking new ideas and action in different ways.

What was evident in the project was the power of collective action, and it is the power we’re now focusing on in a project about energy – electrical, community, and artistic. Inspired directly by Ann’s work on the Green New Deal, we are setting out to build a cooperative power station across the rooftops of Walthamstow. This again takes us on a big learning curve, and we’re working through it all and seeing if there is an opportunity to weave debt cancellation into this one, in relation to fuel poverty and debt. We’ll be printing a new currency – the Green Backs – inspired by the original US greenbacks, as another variation on sovereign money creation backing this grassroots Green New Deal. So Hoe Street Central Bank lives on, playing with, subverting, and creating other financial instruments that work for the people not against them. Even on a national scale, mass debt cancellation would never be a complete solution, but it would press the reset button, alongside a raft of other measures urgently needed to tackle the deep inequities involved in the climate crisis. If the government are not acting fast enough, how might we be able to do a project that can make some impact, starting from our house and radiating outwards? Again there will be a film, but the whole process is a kind of gesamtkunstwerk involving mass participation and art production.

Gavin Turk: This sounds like perfect material for the next project, a film about local green ambitions with world implications, benefitting from all that learning of the financial system you’ve been doing. Ann, are you working on a new project?

Ann Pettifor: I’m writing about how the world’s central bankers provide bailouts and finance for institutions such as Wall Street (at very low rates of interest), but do not ensure that finance is available at low rates for the real economy, the climate, or to end austerity. It’s about how the civil servants at the US Federal Reserve, the world’s central banks, have become servants to Wall Street; whereas societies need them to act in the service of the real economy – just as the chiefs in villages once acted as servants to their community by upholding standards, managing interest rates, and regulating transactions and obligations.

All photography Peter Searle

This article is taken from Port issue 29. To continue reading, buy the issue or subscribe here